Simple Sales Tax Calculator Guide for Digital Marketers

As a digital marketer, keeping track of sales tax can feel like trying to solve a hard problem.

But what if you had a simple tool to help you figure it all out? Enter the Sales Tax Calculator.

This handy tool can save you time, effort, and ensure you're always on top of your game when it comes to managing sales taxes.

We'll go over everything you need to know about utilizing a sales tax calculator in this guide.

What is a Sales Tax Calculator?

A Sales Tax Calculator is an electronic application designed to calculate the amount of sales tax you need to add to your products or services. It’s like having a digital assistant that quickly crunches the numbers for you.

To obtain the total amount including tax, simply input the item's price and the relevant tax rate into the calculator. This tool ensures precise pricing and avoids any miscalculations, which is very helpful for businesses and consumers alike.

Whether you're at home or on the go, a sales tax calculator provides a simple, efficient way to handle your sales tax needs.

Why Use a Sales Tax Calculator?

Have you ever tried to figure sales tax by hand? Errors are common, particularly when working with disparate tax rates in different areas.

Using a sales tax calculator can help you stay error-free and make sure you're charging the right amount.

Plus, it saves you precious time, allowing you to concentrate on other important aspects of your business. Also, a sales tax Calculator can help you stay biddable with duty regulations, reducing the threat of expensive penalties.

It also provides a professional touch to your transactions, enhancing your credibility with customers. In a fast-paced world, this tool is invaluable for efficiency and accuracy.

How to Use a Sales Tax Calculator

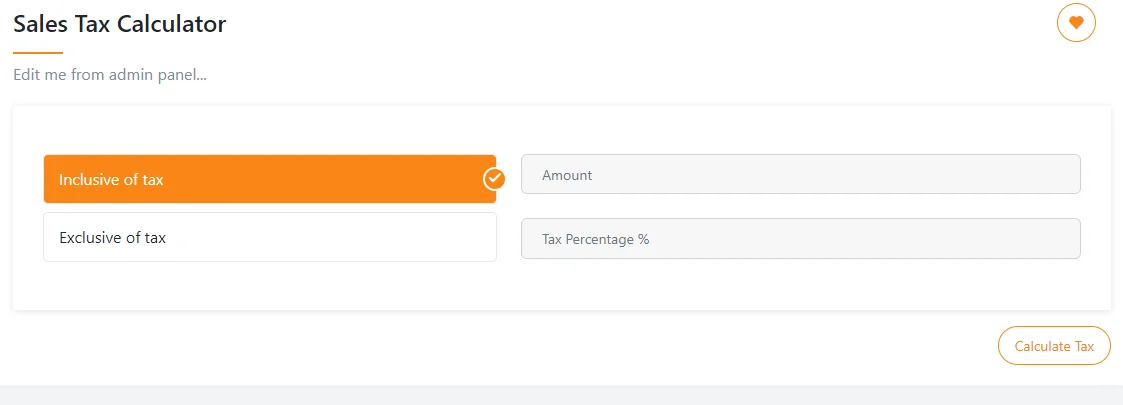

Using the Techiztools sales tax calculator is straightforward. Here’s a step-by-step guide:

Visit the tool by clicking the tool link https://techbiztools.com/sales-tax-calculator

#1. Enter the amount for which you want to calculate the sales tax in the given box.

#2. They are two options of your choice. Choose “GST Inclusive” if you want to add GST otherwise, select “GST Exclusive.”

#3. Input the amount in the “Amount” box and the Percentage in the “Percentage” Box.

#4. Then, click on “Calculate Tax” for your result.

#5. Boom, your sales tax will be calculated.

It’s that simple! This tool can be particularly useful during checkout processes or when pricing new items.

Features of a Good Sales Tax Calculator

Not all sales tax calculators are created equal. Here are some features to look for:

#1. User-Friendly Interface: It should be intuitive and easy to navigate, ensuring that users of all skill levels can operate it without difficulty.

A clean layout with clear instructions helps avoid confusion and speeds up the process.

#2. Accuracy: It must provide precise calculations to ensure that you are charging the correct amount of tax.

This helps prevent undercharging or overcharging customers, which can lead to financial discrepancies or compliance issues.

#3. Customization: The calculator should have the ability to handle different tax rates and regions.

This is crucial for businesses that operate in multiple locations with varying tax laws. Customization options might include setting specific tax rates, exemptions, and thresholds.

#4. Integration: Compatibility with your existing systems and platforms, such as accounting software, e-commerce platforms, and POS systems, is essential.

This ensures a seamless workflow and minimizes the need for manual data entry, reducing the risk of errors.

#5. Support: Reliable customer service is important in case you encounter any issues.

Whether it's through live chat, email, or phone support, having access to knowledgeable and responsive support staff can help resolve problems quickly and efficiently.

#6. Security: Ensures that your data is protected and confidential. Look for calculators that use encryption and other security measures to safeguard your financial information and transactions from unauthorized access.

#7. Updates: Regular updates to reflect the latest tax laws and rates are essential.

Tax regulations can change frequently, so it's important that your calculator stays current to ensure compliance and accuracy in your calculations.

#8. Multilingual Support: Offers functionality in multiple languages to cater to a diverse user base.

This feature is particularly useful for international businesses or regions with multilingual populations, ensuring that all users can understand and use the tool effectively.

#9. Mobile Compatibility: A good sales tax calculator should work well on mobile devices, allowing users to calculate taxes on the go.

This flexibility is especially beneficial for small business owners and freelancers who may not always have access to a computer.

#10. Detailed Reporting: The ability to generate detailed reports on tax calculations can be invaluable for record-keeping and auditing purposes.

Look for features that allow you to export data in various formats, such as PDF or CSV, for easy analysis and sharing.

#11. User Permissions: The option to set different user permissions can be useful in a business setting. This allows you to control who can access and modify certain settings or data, enhancing security and operational control.

Common Mistakes to Avoid

Even with a sales tax calculator, mistakes can happen. Here are some common pitfalls to watch out for:

#1. Incorrect Tax Rates:Verify the tax rates you enter twice a day. Inaccurate rate usage may result in under- or overcharging clients, raising the possibility of financial irregularities and compliance problems.

#2. Tax Rates Not Updated: Duty rates can change, so insure your calculator is over- to- date.

Regularly check for updates or changes in duty laws to ensure your computations remain accurate and biddable with current regulations.

#3. Ignoring Exemptions: Some items might be tax-exempt or have special rates. Make sure to account for any exemptions or special tax rules that apply to specific products or services to avoid miscalculations.

#4. Relying Solely on Defaults: Customize settings according to your specific needs. Default settings might not always align with your business requirements, so take the time to adjust the calculator’s settings to match your unique tax situation.

#5. Keeping an Eye on Several Tax Authorities: If your business operates in multiple locations, ensure you apply the correct tax rates for each jurisdiction.

Different regions may have varying tax laws and rates, and failing to account for these differences can lead to errors.

#6. Failing to Document Calculations: Keep detailed records of your tax calculations. This helps in verifying accuracy and can be crucial during audits or when resolving any disputes.

#7. Ignoring Updates and Maintenance: Regularly update your calculator software to benefit from new features, bug fixes, and compliance with the latest tax laws. Ignoring updates can result in outdated and inaccurate calculations.

#8. Neglecting Customer Inquiries: Be prepared to address customer questions about tax calculations. Providing clear explanations and having a well-documented process can enhance customer trust and satisfaction.

Benefits for Digital Marketers

As a digital marketer, leveraging tools like a sales tax calculator can significantly enhance your operational efficiency and customer satisfaction.

Here's a thorough explanation of the advantages a sales tax calculator can provide:

#1. Time-Saving: Automating duty computations through a sales tax calculator saves you substantial time that would otherwise be spent on manually probing and calculating duty rates.

You may concentrate on high-value activities like ad campaign optimization, customer data analysis, and innovative marketing strategy development thanks to its efficiency.

#2. Error Reduction: Tax computation errors made by humans might result in disparities in finances and even legal problems.

You may reduce the possibility of mistakes and make sure that your financial records are correct and in compliance with tax laws by utilizing a trustworthy sales tax calculator. Your credibility with stakeholders and regulatory agencies is increased by this dependability.

#3. Improved Customer Experience: Accuracy in pricing is crucial for maintaining customer trust and satisfaction. A sales tax calculator helps you provide transparent and precise pricing, showing customers exactly what they will pay, including taxes.

This transparency builds trust and reduces the likelihood of abandoned carts or customer dissatisfaction due to unexpected costs at checkout.

#4. Operational Efficiency: You may reduce the administrative load associated with human tax computations and streamline your process with automated tax calculations.

This effectiveness boosts output while freeing up your staff to concentrate on essential marketing tasks like campaign optimization, content production, and market research.

#5. Compliance and Risk Management: Staying compliant with tax laws and regulations is critical for any business.

A sales tax calculator ensures that you apply the correct tax rates based on location and product type, reducing the risk of non-compliance penalties.

It also helps you stay updated with changes in tax rates or laws, ensuring that your business remains agile and adaptable.

#6. Cost Savings: By reducing errors and improving efficiency, a sales tax calculator ultimately helps you save costs associated with tax overpayments, fines, and the resources required for manual tax processing.

These cost savings can be reinvested into marketing initiatives or other areas of business growth.

#7. Data-Driven Decision Making: You can use the information gathered from precise tax data to guide strategic choices for all of your marketing initiatives.

Gaining insight into the effects of taxes on pricing and profitability can help you target new markets, improve pricing tactics, and more precisely predict sales.

Choosing the Right Sales Tax Calculator

With a plethora of sales tax calculators available, finding the optimal one for your needs requires careful consideration of several factors:

#1. Compatibility: Ensure that the sales tax calculator integrates seamlessly with your existing tools and platforms. Compatibility issues can disrupt workflow and lead to inefficiencies.

Verify compatibility with your accounting software, e-commerce platform, and other essential business applications.

#2. Features: Evaluate the features offered by different sales tax calculators and prioritize those that align with your business requirements.

Advanced features such as automatic tax rate updates, multi-jurisdiction support, and reporting capabilities can significantly enhance efficiency and accuracy.

#3. Cost: Consider the cost implications of each sales tax calculator. While some calculators may be free, others might require a subscription or charge based on transaction volume.

Assess how the cost aligns with your budget and the value it delivers in terms of time savings, accuracy, and compliance.

#4. Reviews: Research user reviews and ratings to gauge the reliability and performance of the sales tax calculator.

Feedback from other users can provide valuable insights into factors like customer support responsiveness, ease of use, and accuracy of tax calculations.

Integrating with Your E-commerce Platform

Smooth integration of the sales tax calculator with your e-commerce platform is crucial for operational efficiency and compliance:

#1. API Integration: Most modern sales tax calculators offer Application Programming Interface (API) integration, allowing seamless connectivity between the calculator and your e-commerce platform.

API integration automates tax calculations during checkout, ensuring accuracy and compliance without manual intervention.

#2. Plugins and Extensions: Utilize plugins or extensions tailored for popular e-commerce platforms such as Shopify, WooCommerce, or Magento.

These plugins simplify integration by providing pre-built connectors that sync the sales tax calculator with your platform's checkout process and order management system.

#3. Custom Solutions: If your e-commerce platform is custom-built or uses proprietary systems, consider developing custom integration solutions.

Engage with a developer experienced in integrating third-party APIs to ensure a tailored solution that meets your specific business requirements.

Frequently Asked Questions (FAQs)

1. How do I find the correct sales tax rate for my area? You can check your local government’s website or use an online sales tax lookup tool.

2. Can a sales tax calculator handle different tax rates for different products? Yes, many advanced calculators allow you to input multiple tax rates for different products.

3. Are there any free sales tax calculators available? Yes, there are several free options online. However, they may have limited features compared to paid versions.

4. How often should I update the tax rates in my calculator? You should update the tax rates whenever there is a change in the applicable rates. Regular quarterly checks are recommended.

5. Can I integrate a sales tax calculator with my existing accounting software? Many sales tax calculators offer integration with popular accounting software. Check the compatibility and integration options provided by the calculator.

Conclusion

When it comes to monitoring and computing sales taxes, a sales tax calculator is a priceless tool for digital marketers.

You may save time, cut down on mistakes, and boost your company's overall efficiency by selecting the appropriate calculator and using it well.

So, why not make your life easier and start using a sales tax calculator today?

Make your work easier by using Techbiztools Sales Tax Calculator by visiting Techbiztools.com/Sales-Tax-Calculator